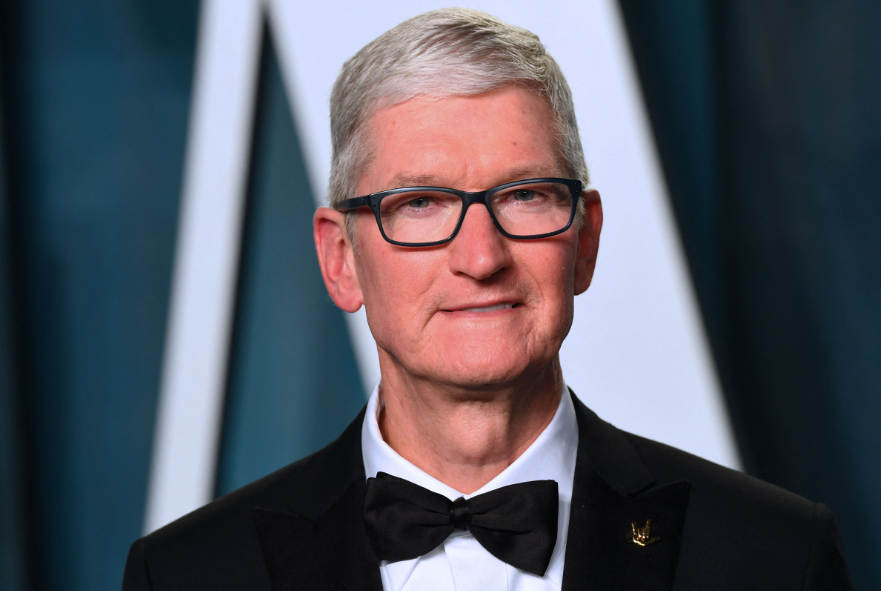

Apple’s CEO, Tim Cook, has been significantly boosting his earnings since assuming his role. Recently, he realized more than $41 million in post-tax proceeds from the sale of his stock. Cook decided to divest 511,000 shares, which initially held an approximate value of $87.8 million before accounting for tax considerations, as detailed in a filing made available by the US Securities and Exchange Commission.

According to the filing published on Tuesday, Tim Cook’s most substantial share sale in the past two years amounted to about $41.5 million after taxes. In contrast, he had previously earned $355 million from a stock sale back in August 2021. Following this latest transaction, Cook still holds approximately 3.3 million Apple shares, which are estimated to be worth around $565 million.

The value of Apple’s stock has undergone a 13 percent decline since its peak at $198.23 in July. This decline has raised concerns among investors about the slower-than-expected recovery in the demand for smartphones. In response to this situation, Apple introduced its new iPhone 15 series last month while maintaining its price levels, a strategic move aimed at addressing the global decline in smartphone sales.

Before the market opened, Apple’s shares experienced a 0.6 percent decrease. On Wednesday, analysts at KeyBanc downgraded the stock from “overweight” to “sector-weight.” They expressed concerns about the anticipated slowdown in sales growth within the United States, Apple’s largest market segment, during the fourth quarter. This slowdown was attributed to fewer US consumers upgrading their devices due to concerns about rising inflation.

A report from the research firm Canalys projected a 12 percent decline in North American smartphone shipments for the year 2023. This report further underscores the challenges that the smartphone industry is currently confronting.